“The purpose of a business is to create and keep a customer” – @ Peter Drucker – and I can’t agree more! Customer retention is an integral driver of ‘Customer Life Time Value’ (think about this as total revenue earned per customer before she defects from the service multiplied by the ‘margin’ in the business) which in turn drives business ‘Profitability’ – if you make more money from the customer than that spent on customer acquisition you have a profitable business at hand. With a mindset that retention is a ‘profitability’ driver and not a growth driver, entrepreneurs seek to drive growth primarily through acquiring new customers. So what are we missing here?

While ‘retention’ is a clear driver of long term profitability, I have observed entrepreneurs miss / forget that ‘retention’ is as important a ‘Growth’ driver as new customer acquisition. I will take one step ahead and call it a ‘Super Growth’ driver – I use the term ‘Super’ simply because, in my experience, growth driven by retention is always more capital efficient than that driven by acquiring new customers.

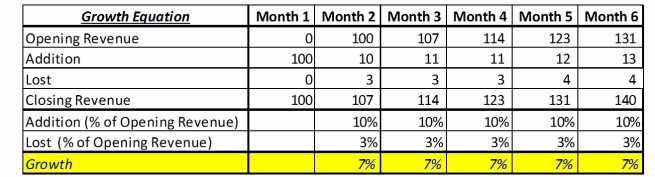

Before we delve into understanding the impact of retention on growth, its important to set up the ‘Growth Equation’ for the business. And it is as simple as the following –

Revenue Growth (%) = (Revenue from New Customers less Revenue lost due to customer defections) / (Revenue from previous month)

I use the following very helpful syntax ((I call it the ‘Growth Accounting Syntax’ as it reminds me of my accounting classes in business school) to further understand the growth drivers for my portfolio companies –

The above table looks at the growth trajectory for a firm that started operations in Month 1 by acquiring $ 100 of revenue. In Month 2 it adds $ 10 in revenue from new customers and loses $ 5 of revenue from customer defections. The net addition is $ 5 for the month consequently, the growth is 5%. As you read through this ‘Growth Accounting Syntax’ for the business you will appreciate a fundamental tenet often lost in the heat of growing fast – growth is the difference between new revenue and revenue lost from defecting customers. Which means that in order to maximize growth, you need to maximize the difference between new revenue acquired and revenue lost due to customer defections.

The above table looks at the growth trajectory for a firm that started operations in Month 1 by acquiring $ 100 of revenue. In Month 2 it adds $ 10 in revenue from new customers and loses $ 5 of revenue from customer defections. The net addition is $ 5 for the month consequently, the growth is 5%. As you read through this ‘Growth Accounting Syntax’ for the business you will appreciate a fundamental tenet often lost in the heat of growing fast – growth is the difference between new revenue and revenue lost from defecting customers. Which means that in order to maximize growth, you need to maximize the difference between new revenue acquired and revenue lost due to customer defections.

Now that we are clear with the growth equation, lets build some scenarios –

Scenario I – reduction in lost revenue by 2% Any reduction in lost revenue is a commensurate gain in growth rate. The important point that I am driving here is that the company was able to increase growth rate without increasing the rate of new customer acquisition! (Phew!)

Scenario II – the curious case of negative churn!! This is a very special and powerful characteristic wherein, the company loses customers month on month but customers that continue to stay with the company spend much more with the service – and this increased revenue from retained customers covers for the revenue lost from defecting customers. Look at what happened to the growth rate in this scenario – the company grew faster than the rate of new revenue acquisition! – We call this ‘Negative Churn’ – if you are experiencing this in your business, please do give me a call!  Super-growth companies (read cab aggregation, food delivery, SaaS companies wherein pricing scales with usage) experience this dynamic – some of which comes naturally to the category while a lot of it is engineered by the company in terms of quality of service & intelligent pricing mechanisms!

Super-growth companies (read cab aggregation, food delivery, SaaS companies wherein pricing scales with usage) experience this dynamic – some of which comes naturally to the category while a lot of it is engineered by the company in terms of quality of service & intelligent pricing mechanisms!

Couple of questions that come to me rather quickly once I talk about this –

- How do you calculate revenue lost from defecting customers? Best explained through an example – the business closed month 2 with $ 105 in revenues. Some of the customers that gave us $ 105 in revenues will defect in month 3 and lets say, will transact only worth $ 100 – the difference between the two is $ 5, which is the the revenue lost number

- How do you minimize revenue defection? – is for another blog (or maybe a book) in the making. Having said that, I have observed that building hypothesis for defections based on quantitative data (are these customers coming from a particular channel, particular price point or service line, is the service not good enough in a particular geography, will a particular segment pay more for a certain kind of service etc.) backed by real customer interactions provides the most fertile feedback to reduce revenue defection.

The advantages of retention go beyond growth and following are some of the key advantages that remain under-appreciated –

- The longer the customer stays with the company means she produces more data – which acts as an input for the company to better understand her needs and serve her better – this drives a feedback loop making the service stickier!

- The longer she stays, there are more opportunities for her to talk about the service to other people – bringing down consumer acquisition cost.

To Conclude –

- I would encourage entrepreneurs to build their growth equation this way to fundamentally appreciate the fact that maximizing growth is to maximize the difference between new revenue addition and revenue lost from customer defections.

- Growth meetings to split time and effort across new customer acquisition and retention!

- Power of retention is best observed in the case of ‘Negative Churn’ wherein the company grows faster than the rate at which it acquires new revenue!

- Very few businesses can achieve negative churn (if your business is experiencing negative churn, please give me a call!) having said that, entrepreneurs need to have enough and more ‘irons in the fire’ to minimize revenue loss due to customer defections

- Retention led growth is invariably more capital efficient than growth driven by new customer acquisition

- “Everything starts from nothing”! 🙂 🙂

Fantastic Analysis and thoughts ….Cheets

LikeLike

Fantastic Analysis and thoughts ….Cheers*

LikeLike

Lovely blog you havve here

LikeLike